The level of tension and anxiety regarding the upcoming election is palpable. A recent post in the Wall Street Journal that discusses Taxes, Tariffs, and Debt, mentions some investors are looking to move to the sidelines in anticipation of the upcoming 2024 U.S. Presidential Election. Is this a wise decision or are investors misguided?

Through this article, we aim to demonstrate that fear and moving out of the market is not the appropriate response to the uncertainty of presidential election years. While this election cycle is highly contentious and arduous, historical data suggests that Presidential Election results alone should not be a concern for investors. As we discuss below, single-party control is the outcome to watch for.

Is a Fearful and Cautious Response Justified?

A recent survey conducted by Investopedia found that readers list the following as their top concern for the market in 2024:

- 65% listed inflation

- 52% listed the 2024 elections

- 50% listed war in the Middle East

- 50% listed persistently high interest rates

- 45% listed U.S. relations with China

As evidenced by the Investopedia survey, one of investors’ top concerns for their portfolio in 2024 is the impending U.S. Presidential election. However, this is not a new concern as election cycles are typically unsettling for investors because they represent change. The fear behind this belies in the notion that elections drive market performance.

Although we do not believe this fear is warranted, market indicators have begun displaying signs of investor anxiety. The CBOE Volatility Index (“VIX”) measures expected market volatility, which can also be used to gauge investors’ sentiment. The October 2024 VIX futures encompass the November 5th Presidential vote, and therefore are representative of anticipated volatility surrounding the election. The spread between the October and September 2024 VIX futures is significantly wider than in 2016 or 2020, indicating increased market uncertainty, on a comparative basis. This spread is shown below in Exhibit 1:

Exhibit 1: Spread Between October and September VIX Futures for 2024, 2020, and 2016

Source: Bloomberg

Why Are Markets Pricing in Volatility?

We know that elections represent uncertainty, but what particularly worries the market about potential change?

- Economic Change: Changes in fiscal policies can lead to changes in economic outcomes. For example, if government spending was to increase, inflationary pressure could increase as a result.

- Policy Changes: It is no surprise that political parties in the U.S. hold divergent economic views. As a result, the uncertainty surrounding tax reforms, shifts in government spending, and greater regulatory scrutiny all present possibilities for change.

- Geopolitical Changes: A new administration means foreign policy shifts and changes in trade agreements or diplomatic relations. Foreign policy and trade agreements directly impact economic flows and U.S. growth outlooks.

Geopolitical, policy, and economic changes are all things that could occur under a new administration and the unknown magnitude of these shifts is what drives the feeling of uncertainty for investors.

The Historical Impact: How Elections Impact Portfolios

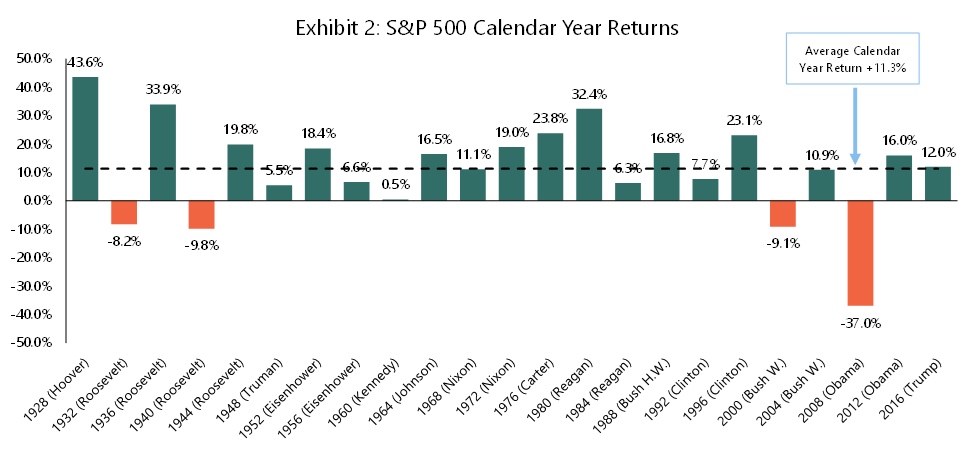

Amongst all the uncertainty surrounding election cycles, there is good news. Historically markets tend to move higher in the long-term regardless of who occupies the White House or Congress. Despite investor fear, the vast majority of election years have been positive for the market, with a few notable exceptions. Exhibit 2 below displays the annual return of the S&P 500 in Presidential Election from 1928 – 2016:

Source: Morgan Stanley & Geller Advisors.

On average the S&P 500 has returned +11.3% during U.S. Presidential election years, but what about the outliers? Typically, election years with negative returns have coincided with major world events such as:

- The Great Depression (1932) and World War II (1940) during the Roosevelt administration

- The Dotcom Bubble (2000) during the Bush administration

- The Great Recession (2008) during the Obama administration

Large scale economic events can drive market performance during election years, but not the elections themselves. As the data suggests, presidential election years have been a good time to invest regardless of the candidates or the eventual winner.

Preparing Your Portfolio for the 2024 Election

While the outcome of the presidential election is unknown, we can predict with a degree of accuracy what policies may or may not be enacted based on which political party is in power.

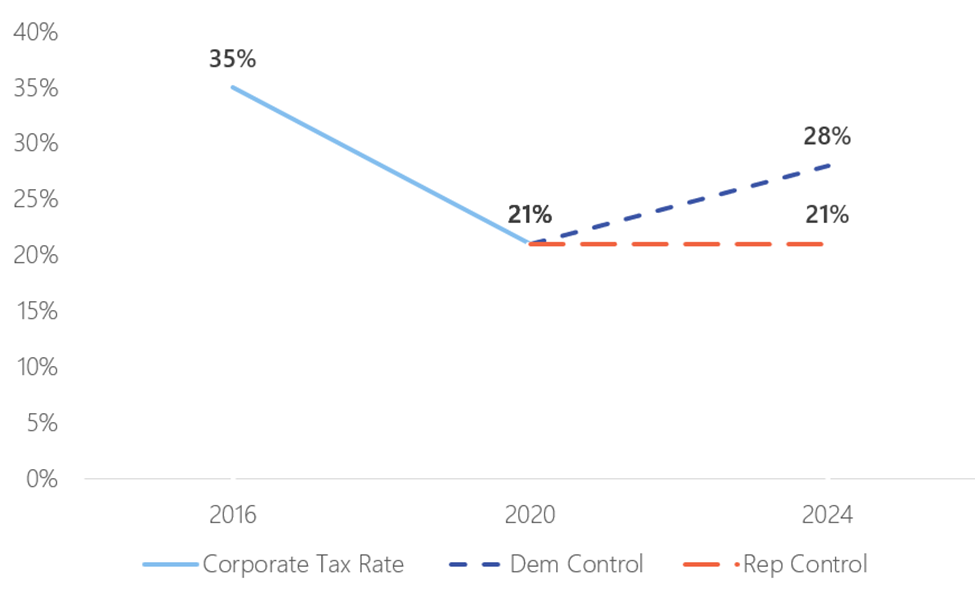

It is likely that if Democrats continue to control the executive branch, they will likely try to increase corporate tax rates and allow Trump-era tax cuts for individuals to sunset at the of 2025. As demonstrated in Exhibit 3 below, corporate tax rates currently sit at 21%, lowered from 35% by the Tax Cuts and Jobs Act (“TJCA”) enacted in 2017.

Exhibit 3: Potential Outcomes of Corporate Tax Rates

This cut was one of the “permanent” changes made by the TCJA and will not sunset with other provisions at the end of 2025. Democrats have expressed interest in raising corporate taxes back to 28%, which has the potential to decrease corporate profit margins and negatively impact the markets.

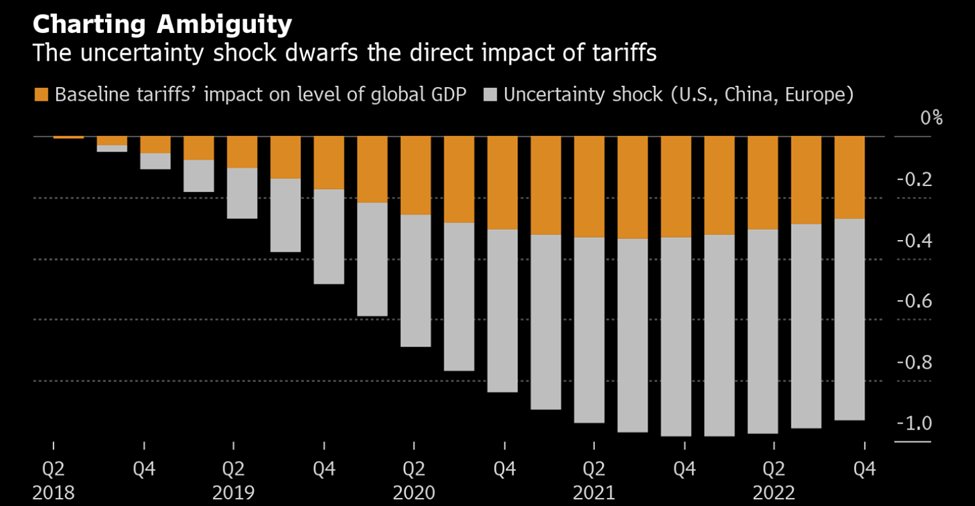

On the opposite side of the isle, if Republicans gain control, they may attempt to implement tariffs. As demonstrated by Exhibit 4 below, the uncertainty shock of additional tariffs could compress global GDP to the magnitude of -1%.

Exhibit 4: Global GDP Shocks of Tariffs

Source: Bloomberg

Some economists believe that isolationist policies like tariffs discourage trade and negatively impact GDP, as is implied above in Exhibit 4. Tariffs can also cause uncertainty which can slow economic activity (i.e., uncertainty shock). Given that we believe markets are driven by economic data and not uncertainty in the long run, isolationist policies could have a negative impact on markets if enacted.

So, what does this mean for you, the investor?

Although some of the U.S. population can be disengaged from politics, people care about their portfolios. Investors prefer stability and predictability, so it is only natural that they become more cautious as the election approaches. However, this mindset should be altered for several reasons.

- Single-party control is the environment in which we most often see true policy shifts. Splits, for example where Democrats control the House, but Republicans control the Senate, often lead to gridlock.

- The president has very little impact on policy: Our system of checks and balances (e.g., separation of powers, bureaucratic hurdles, judicial review, etc.) means the president cannot implement sweeping agendas on their own.

- Historically markets have performed well in election years: A fearful and cautious response may lead to missed opportunities. We recommend staying invested in the market.

- Dips in the market are typically driven by unexpected events like missed earnings, major conflicts, or global emergencies: These are “unknown unknowns”; as a result, investors should take a long-term approach to markets and avoid the urge for “perfect timing”. We believe that an investor should strive for “time in the markets” rather than “timing the market”.

Should Investors Worry about the Upcoming Election?

The tension and anxiety regarding the upcoming election is understandable, but it is not a compelling reason to move your portfolio to the “sidelines”. Fear makes us believe elections drive market performance, though as demonstrated in this article, historical data shows that is not the case.

So, how should you prepare for the upcoming election?

Avoid emotional, short-term decisions; focus on being a long-term investor. Contact your wealth advisor to ensure your portfolio aligns with your long-term investment goals and objectives. Lastly, keep an eye on single party control of the White House and Congress that could lead to shifts in policy and tax regimes.

Contact us for deeper insights on navigating todays markets.