Many in the financial and estate planning fields primarily focus on managing cash flow during their clients’ lives and minimizing their estate taxes. However, an ancillary planning tactic—and something that we find is often overlooked—is, when an individual passes away, maximizing charitable contributions with certain retirement plan assets, such as Individual Retirement Accounts (IRAs) and 401(k) accounts, becomes a compelling option. Although such retirement plans cannot be tax efficiently transferred to charity during a person’s lifetime, as explained below, when done at death it may provide for substantial income tax savings.

The effort to maximize charitable dollars is not new. In fact, it’s been a focus for individuals and families who are currently committed to charitable causes (including the more than 225 who have signed the Giving Pledge), as well as early wealth creators like the Carnegie and Rockefeller families (who were some of the first families subject to the estate tax when it was introduced in the early 20th century).

As we subsequently explain, families who hope to fulfill philanthropic endeavors through their estates can take advantage of this estate planning strategy that maximizes funding charitable causes while simultaneously reducing estate taxes.

Why it Pays to Flip the Script: The Compelling Economic Benefit of Bequeathing Retirement Assets to Philanthropy

Frequently, when formulating an estate plan, affluent individuals have an initial preference to bequeath cash and its equivalents to philanthropy while assigning their spouse or children as the beneficiaries of their retirement assets, such as Individual Retirement Accounts (IRAs) and 401(k) accounts.

Because most traditional retirement plans have yet to be subject to income taxes—and will generally not be until they’re withdrawn —they have often grown in value to comprise large portions of one’s estate. Further, retirement accounts do not receive a step up in income tax basis to their fair market value in an estate. This means that noncharitable beneficiaries must treat distributions in the same manner as the participant would have if they were alive, that is, as ordinary income.

Charitable organizations, on the other hand, are generally exempt from income taxation, including distributions from retirement plans. These factors combined are compelling reasons to overcome the misconception that retirement assets are best used for family bequests, when in fact, it is often best to leave retirement assets to philanthropic recipients.

Demonstrating the Value in New York City and Non-Tax States

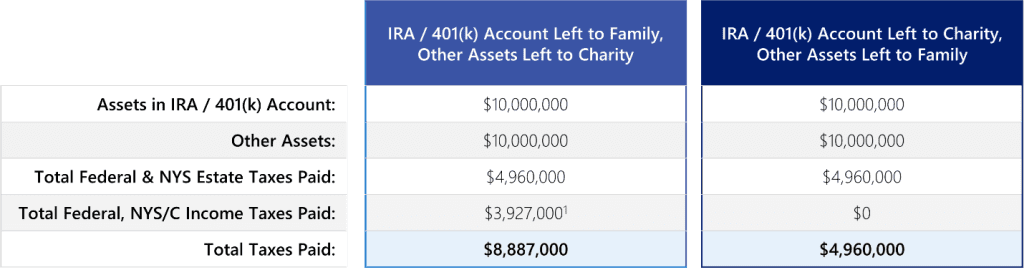

The following example demonstrates the magnitude of “flipping the script” for an individual with a gross estate that far exceeds their lifetime exemption amount and assumes no growth and income in the retirement account after the person has passed away. In a scenario where both the decedent and the inheritor live in NYC, where the retirement account will be subject to both estate and income tax, gifting a retirement account to charity saves close to $4 million on a retirement account of $10 million.

1 This illustration uses top federal, NYS and NYC income tax rates.

Consider that the above analysis shows that estate and income taxes on a $10 million retirement account would be $8.9 million, leaving the inheritor barely more than $1 million. Given that the entire $10 million could be given to charity with $0 estate and income taxes, consideration should certainly be given to a philanthropic allocation.

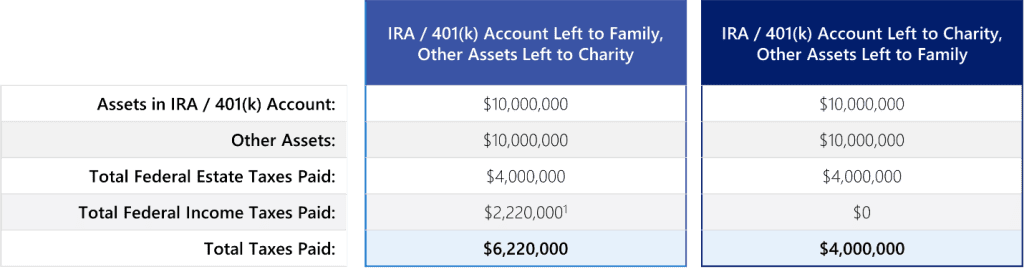

For those who reside in non-tax states, such as Florida, the financial impact is not as great, but still yields a meaningful economic outcome. The example below demonstrates the incremental amount of taxes by providing a $10 million retirement account to a family member would be $2.2 million (as opposed to the $3.9 million in the example above).

1 This illustration uses the top federal tax rate.

What about Roth IRAs?

Unlike traditional IRAs and 401(k)s, Roth IRAs will not be subject to income taxes when distributed to beneficiaries. Accordingly, Roth IRAs are absolutely worth considering for family bequests.

It Doesn’t Have to Be All or Nothing: Designating Various Beneficiaries

All retirement accounts require a beneficiary designation, which identifies where the funds in the account will go when the account owner passes away, be that to individuals or charitable institutions. More than one beneficiary can be identified to receive portions of the account.

Accordingly, allocating all or a portion of the account balance to charity is as simple as changing the beneficiary designation on file with the financial institution. It’s not only possible to change the allocation, which often occurs as an individual’s wealth evolves over time, but there is no limit on the number of parties that can be identified nor is there a limit on the frequency of changes that can be made. In comparison, making a similar change of beneficiary in your will is more complicated.

We have also seen families change their allocations in order to empower their younger generations to oversee future philanthropic activities and have even seeded family foundations in advance to start the process sooner.

Taking Action: What are the Options?

In order to implement a charitable beneficiary designation (full or partial), it is imperative to consider the options. There are generally three options, including a combination of the three. Here is a quick summary of these options:

- Private Family Foundation: Ideal for those who wish to create a legacy to ensure their name, charitable mission, and philanthropic goals live on. Investment income is taxed at only 1.39% and annual gifting of 5% of the foundation’s assets is required.

- Donor Advised Fund (DAF): Preferable for those who do not want to take on the administrative responsibilities a private foundation requires, and who may want to donate anonymously. DAFs, taxed as public charities, are not subject to the 1.39% investment income tax, and do not require annual gifting.

- Direct Donation to Public Charity: Best for those with a clear understanding of the exact organizations they’d like to support.

In Conclusion

The sheer stakes ensure that this is no laughing matter, for the sums involved are substantial. According to one recent study of the affluent, retirement accounts alone comprise over half of overall wealth. Another survey, meanwhile, showed that ultra-high-net-worth individuals are now responsible for almost 40% of all individual charitable giving, which can be done efficiently with traditional retirement plans while eliminating their inherent income tax liabilities.

Estate planning can undoubtedly involve some fraught talks, entailing discussions about mortality. However, it can help to reframe the conversation to focus on the substantial savings that can accrue through proactively putting smart tax strategies in place, as doing so can help to provide long-term financial security, as well as priceless peace of mind, for your family and heirs.

If you’d like to ensure your estate planning blueprint best reflects your wishes, in the most tax-advantaged manner, our trusted team of experienced tax advisors is happy to help. Don’t hesitate to connect.